The nsw land tax is calculated using the appropriate nsw land tax rate on the total value of all your taxable land above the land tax threshold 629 000.

Land valuation calculator nsw.

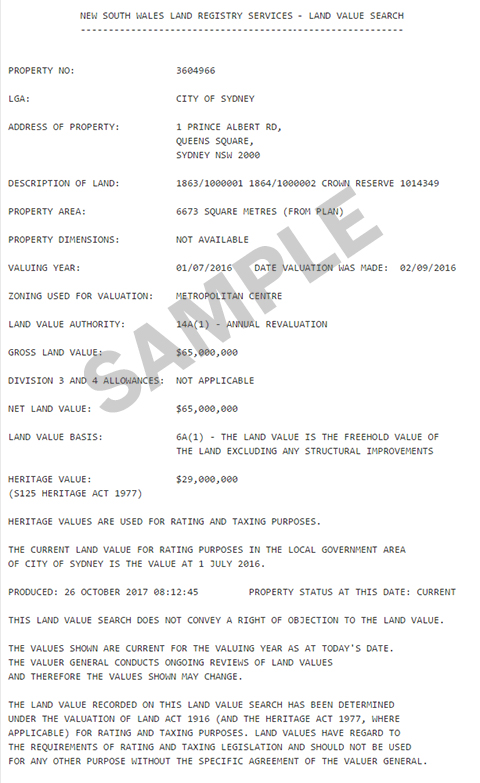

A notice of valuation shows the land value of a property based on property market conditions.

Land values for rating purposes are supplied by the valuer general s office every 3 to 4 years.

You can use it to access information for a property including.

The land values and property sales map also includes land value information.

You can find out the land value and other details of your property going back to 2001 online.

These include free land value searches valuation sales reports and an online facility to lodge an objection to your land value.

Land tax assessment from revenue nsw.

Updating your home facts can help make your zestimate more accurate.

The valuer general nsw valuation portal provides the community industry and other government agencies with access to valuation products and services.

Your council will calculate rates based on your property s land value either.

The zestimate home valuation is zillow s estimated market value for a home computed using a proprietary formula.

Councils for calculating and distributing rates.

You can explore land values throughout nsw.

Enter your address or property id number found on your land valuation notice pdf 2 4mb.

Notice of valuation from the valuer general.

Revenue nsw for calculating land tax liability.

Combined with a fixed amount.

You can find your land value on your.

If your land value increases it doesn t necessarily mean your rates will rise as they depend on.

It gives landholders the opportunity to consider their land value before it is used by council.

The valuer general determines the value of land and every 3 years provides a notice of valuation to property owners.

When calculating your land tax don t include dollar signs commas spaces or cents.

Find your annual land valuation.

You can get an estimate of how much tax you have to pay using the online land tax calculator.

It is a starting point in determining a home s value and is not an official appraisal.

Land tax is a tax levied on the owners of land in nsw as of midnight on 31 december of each year.

The zestimate is calculated from public and user submitted data.

Land values help councils calculate and distribute rates.

Land values are used by.

View your property s statutory land valuation and related data for your area.

Alone but sometimes subject to a minimum amount or.